Bitcoin Personal Banking

Free IBAN Bank Account

With RFS Profit you can open your personal Bitcoin Bank account with your own German IBAN in just a few minutes. You can easily send and receive money transfers.

Free Bitcoin Debit Card

With every RFS Profit Bank account you will also receive a free Bitocin Debit Card, which you can load directly with over 50 cryptocurrencies.

Instant Card Top up

Log in to your mobile app to fund your crypto debit card or bank account with all known cryptocurrencies in a matter of seconds.

50+ Cryptocurrencies

RFS accepts 50+ Cryptocurrencies for topping up the Bitcoin prepaid card and your IBAN bank account. After the second blockchain confirmation, the amount will be credited to your account.

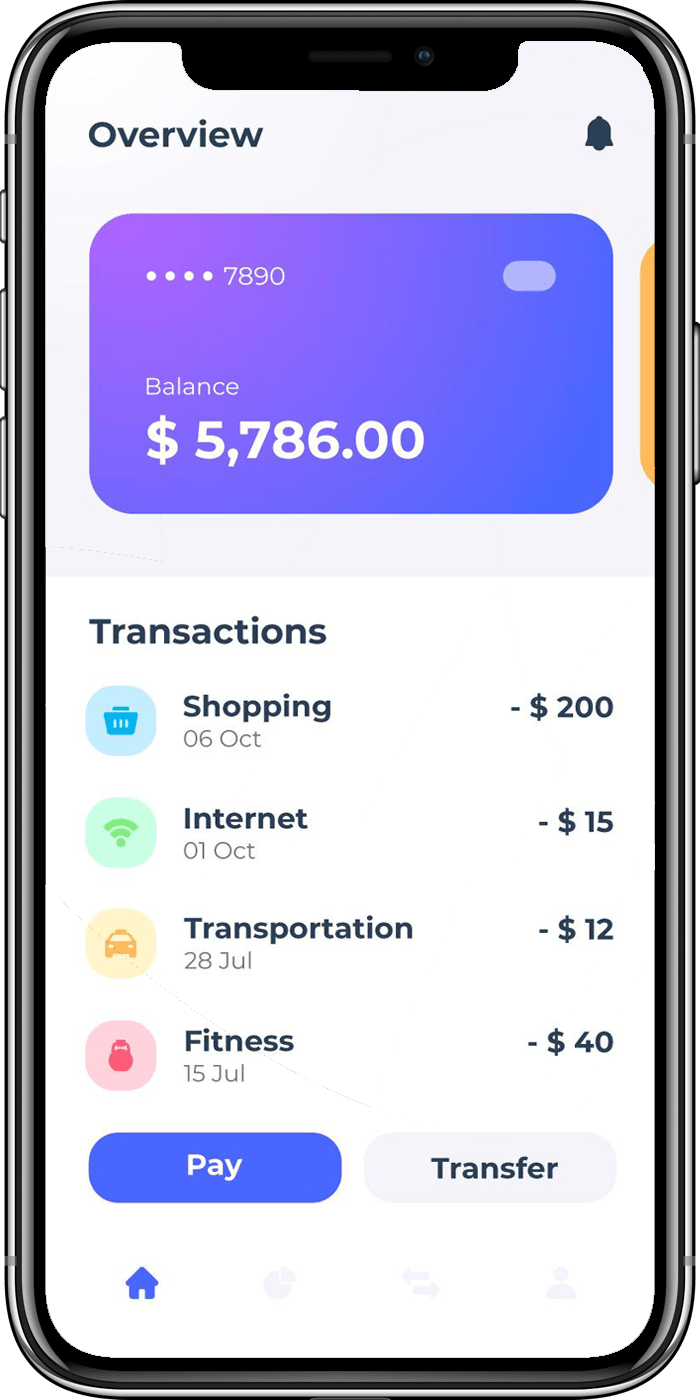

Android + IOS Mobile App

Use your daily crypto banking from anywhere in the world via the Convenient Android and IOS App. Download it now from the App Store.

Europe Location

RFS Profit is based in Europe and offers crypto banking and debit cards through its partner bank.

Banking FAQ

What is a virtual card?

A virtual card, also known as a virtual debit or credit card, is an account number that you can use to make purchases online. It's similar in concept to the way you use your physical credit cards at stores and restaurants. You can buy things with it just like cash.

The difference is that when you buy something with a virtual card, the money goes into your bank account instead of directly to the merchant. This means that if you don't have enough money in your checking account, you won't be able to pay for your purchase until later.

How do I create a virtual card?

You can add a virtual card from any page on our site by clicking "Add Card", then choosing "Virtual Account". After you've created a virtual card, you can select it from the list of available accounts when making a payment.

How do I delete a virtual card?

You can remove a virtual card by selecting "Delete Account" under "My Accounts" and entering your email address. If you want to keep track of how much money you spend using a virtual card, you'll need to enter your password when you log in again.

What are the benefits of adding a virtual card?

Virtual cards give you access to all of our features:

- View balances

- Make transfers between your accounts

- Check your balance history

- Pay bills

- Track spending

- Receive alerts about low balances

- Make online payments for online products

- Contactless payments

- Online shopping

Who is the virtual card great for?

Anyone who wants to get started using their own virtual card without an plastic card. Virtual cards work best if you're new to banking because they require no additional information beyond a valid email address. They can also save you time and hassle. For example, you can sign up for automatic payments through your virtual card without having to remember to set up recurring payments each month.

Can I use my regular bank account to fund my virtual card?

Yes! When you first register for a virtual card or anonymous prepaid debit card, we ask whether you'd prefer to fund it with your existing checking or savings account. Once you confirm this preference, we will transfer funds from your current account to your new one.

Want to learn more about the Bitcoin Virtual Debit Card?

The Bitcoin Virtual Card or Crypto Debit Card works similarly to a traditional debit/credit card. To make a transaction, you simply need to enter the amount you wish to charge to your virtual card, choose a method of payment (e.g., PayPal) and click “Pay Now”. Your payment is immediately processed and your virtual card debits the appropriate amount from your bitcoin wallet.

Is there a fee associated with using the Bitcoin Virtual Card?

There are no fees on Debit Cards. However, transactions may take longer than usual due to increased network congestion during peak hours. You dont need any minimum balance.

What are the pros and cons of using a virtual debit card?

Pros:

- No monthly fees

- No minimum deposit required

- Can be used anywhere Visa is accepted

- Easy setup

- Instant card details

- Direct deposit

- Corporate card

- Mobile wallet

- Replacement debit card

- Personal card

- No credit check

- Small transaction fees

Cons:

- Requires a computer or mobile device

- May not work everywhere

- Not FDIC insured

- No overdraft protection

- Transaction limits apply

- Cannot be used for ATM withdrawals

- Some merchants may not accept it

- Small fees on debit card

How do I get a virtual card?

To get a virtual card or instant debit card, visit https://rfsprofit.com. Please note that only individuals 18 years old and older are eligible to receive virtual cards. After the application you will receive your 16-Digit Card Number or Virtual Credit Card Number. Also, online banks like Bank Of America offers its own business credit cards but only with verification.

Does my virtual card expire?

Your virtual card never expires — once you create an account, you can continue to use it indefinitely. The cards have card expiration dates but are automatically renewed. The card limits are 20 000$ per month. Get your card in minutes now.

Can I use my virtual debit card in an ATM?

You cannot use a virtual debit card (prepaid card) at ATMs, only a physical debit card or physical card (physical plastic card). The virtual credit card is designed specifically for online purchases and its a Digital Card like digital wallets.

Do I have to verify my identity before creating an account?

No. We don't collect any personal identifying information like your name, date of birth, social security number or driver license number. Instead, we rely on public records and other third-party data sources to identify you.

Is a virtual debit card safe?

Yes. All financial institutions follow strict guidelines when it comes to fraud prevention. In addition, all transactions are secured through SSL encryption technology, which protects your personal information. If you ever experience problems with your virtual card, please contact us at [email protected] immediately. We offer the highest Layer Of Security for Digital Payments with Extra Security like a Security Code to get Access To Funds.

What is RFS Profit?

RFS Profit is an online Bitcoin / Crypto Bank and virtual card provider offering virtual Bitcoin debit cards and Bitcoin IBAN bank accounts. There are many more virtual credit card providers but many require many customer inforamtions.

What banks are crypto-friendly in USA?

The most popular US banks for cryptocurrency users are:

- Wells Fargo

- Bank of America

- Citibank

- PNC

- Chase Bank

- TD Bank

- U.S. Trust Company

- SunTrust Banks

- BB&T Corporation

- Regions Financial Corporation

- Huntington Bancshares Inc.

- American Express

- Capital One

- ING Direct

- State Street Corp.

- Ally Invest

- Charles Schwab & Co., Inc.

- Fidelity Investments

- Fidor Bank

- Ameritrade Holding Corp.

- Goldman Sachs

- Interactive Brokers Group, LLC

- Ally Bank

- Simple bank

Are there any other US banks that accept cryptocurrencies?

Yes! There are many banks in the United States that accept Bitcoin and/or Altcoins as a form of payment or offer a crypto-friendly bank account. Many crypto exchanges also allow you to convert your crypto assets into traditional currencies beforehand.

What is Bitcoin?

Bitcoin is a digital currency that was created by Satoshi Nakamoto, a pseudonymous person or group of people who published their work under the name “The Bitcoin Whitepaper” on October 31st 2008. It's decentralized peer-to-peer payment system allows for online payments to be sent directly from one party to another without going through a financial institution. Some banks and financial institutes also accept cryptocurrency transactions in the financial industry.

What can you do with crypto in the UK?

Cryptocurrency has become an increasingly accepted method of payment in the UK. You can now buy goods and services using bitcoin (BTC) at thousands of locations around the country including high street retailers such as Argos, Asda, Tesco, John Lewis, Sainsbury’s and Amazon, among others.

Barclays: With more then £1.3 trillion of assets, Barclays is one among the oldest and largest bank in the UK. But there are also banks in the EU. Founded in Lithuania, online bank Bankera has become one of the few European banks financial institutions that focus on providing a bridge between traditional banking and cryptocurrencies.

Cryptocurrency friendly banks are financial institutions that understand the cryptocurrency ecosystem. If you're looking for a Swiss bank that allows you to easily and safely convert fiat currency into Bitcoin, Ethereum, and a wide range of other cryptocurrencies, SEBA might be a good choice.

Nuri is a German-based bank (German bank) available to everyone in the EU (except for Gibraltar), the UK, Switzerland, and some other jurisdictions.

The modern bank Wirex is one of the best crypto-friendly banks in the industry and offers an exciting deal for cryptocurrency enthusiasts. You can make instant transfers or crypto purchases in your online banking portal with it as well as use Wires as digital wallets or cryptocurrency trading.

How to Open a Bitcoin Bank Account?

There are several ways to open savings accounts for your business. The first way is to apply for a general banking account. This requires filling out all the required paperwork and submitting it to your local branch. Once approved, this type of account will allow you to deposit funds into your account and withdraw them via ATM card. If you want to have access to more than just cash withdrawals, then you may consider opening a merchant account. This type of account offers virtual card processing services.

In order to get started, you must fill out the necessary paperwork and submit it to your local branch along with a $20,000 USD minimum deposit. After approval, you will receive a merchant ID number that will be used to process transactions.

What to Look for in a Crypto Friendly Bank?

If you're looking for Bitcoin-friendly banks or Crypto bank that accepts cryptocurrency, here are some things you should look for:

- 1. A reliable customer support team

- 2. An easy-to-use interface

- 3. A wide variety of services

- 4. Cryptocurrencies like BTC, LTC, ETH, XRP, DASH, etc.

- 5. Low fees

- 6. Mobile apps

- 7. 24/7 phone support

- 8. Free transfers between accounts

- 9. ATMs

- 10. No hidden charges

- 11. Multiple currencies supported

- 12. High security standards

- 13. Customer care

- 14. Fast response times

- 15. Good reputation

- 16. Easy deposits

- 17. Easy withdrawals

- 18. Accepting new customers

- 19. Allows you to add funds using a credit card, debit card, or bank transfer.

What Makes a Crypto Friendly Bank Different Than a Traditional Bank?

A traditional bank is a company that issues checks and provides loans. They also handle the money that you send them when you make purchases. However, they don't offer any direct deposit options or wire transfer services. For these reasons, most people choose to use a third-party service provider instead. These companies provide similar services but also include additional features. For example, many of them offer free mobile apps and fast transaction speeds. Some even offer multiple currencies so that you can easily convert your money into different types of coins.

How Do I Know if My Bank Is Really Crypto Friendly?

You can find out whether or not your bank is truly friendly towards cryptocurrencies by reading reviews about them. Many reputable websites offer reviews of various financial institutions. By 2020, the largest digital bank Bank of America began allowing all crypto transaction to be done in cash. It deals with cryptocurrencies along with traditional banking.

Do Banks Accept Bitcoin?

Yes! Most banks accept bitcoin payments through their online banking platform. All you need to do is create an account and set up your bitcoin wallet address on your computer. Then, you can deposit your bitcoins into your account and make purchases from merchants who accept bitcoin. Each bank has its own relationship with the crypto space on the crypto markets; however, these are the banks whose clients can use crypto and cryptocurrency exchanges. Crypto investors can exchange their crypto coins for fiat currency (USD) through Coinbase or their crypto wallet.

How Does Cryptocurrency Work?

Cryptocurrency works similarly to how a normal currency does. You purchase bitcoins using fiat currency (dollars, euros, pounds, etc.) and exchange those bitcoins for other digital assets. When you buy a coin, you enter the amount of dollars you wish to spend. Your bank will automatically deduct the appropriate amount of dollars from your checking account. It's important to note that there are no physical coins involved in this process. Instead, each bitcoin has its own unique code that contains information about its ownership history. Bitcoin is one of the virtual currencies along with Bitcoin Cash.

How to trade crypto?

For your daily bitcoin trading you can use the bit trading (Bit Trading Inc.) platform. With the Daily Chart you can follow live the strike price and the trading range. In addition, this provider offers a day trading guide to help you in the beginning. By offering advanced trading features like spot trading on margin and futures trading in a straightforward interface, they have the tools you need to grow your portfolio. The Bit Trade platform is available for iOS and Android devices.

Can I buy Bitcoin with an eCheck?

eCheck stands for electronic check, being used to describe the digitized version of traditional paper check (traditional check). You should use your bank account to purchase Bitcoin if you want to get the most out of this cryptocurrency. Otherwise, you may be charged high fees or lose your money due to hacking attacks. However, you first have to find an reputable exchange where you can trade your cryptocurrency for fiat currency.

How to buy bitcoin with echeck?

You need to select a brokerage platform that operates within your country and accepts payments via eCheck. Once you've selected the platform, you must register for an account, verify the account, then deposit funds using the eCheck payment option. Finally, you must purchase bitcoin.

What brokers accept eChecks as payments for buying Bitcoin?

We have prepared a list of top brokers that you can use if you want to buy bitcoin with echeck or paper checks. Our top recommended brokers are eToro, cex.io, coinbase, and paxful. eToro stands out with good regulatory system, zero commission, and great social trading platform. Paxful is a person-to-person crypto exchange market (peer marketplace) that supports over 300 payment methods. You can also make deposits in USD. You must complete a verification procedure. Several top brokerage platforms and P2P exchanges accept this payment method. But there is a transaction limit, a transaction fee and a trading fee.

How to Store Bitcoin on a Digital Wallet?

Pretty much similar to physical wallets. A Bitcoin wallet is used to save your digital currencies. However, it allows you to transfer them anywhere, and to send them to any place. Moreover, instead of keeping your coins or cash, it actually keeps the information you need to access the part of blockchain where your crypto is kept. Nonetheless, a Bitcoin wallet is the safest way of saving your digital currencies as long they are decentralized. You can choose among many types of Bitcoin wallets, and design your own.

Can you get an anonymous debit card?

We at RFS Profit offer you an anonymous debit card (prepaid card) for cryptocurrencies.You can get an anonymous debit card in the US as long as they're not reloadable. If you're able to reload additional funds onto the card, it won't be anonymous.

What is a bitcoin debit card?

Cryptocurrency debit cards (also known as crypto debit cards) are prepaid debit cards that can be used for online and in-store payments from merchants that don't support cryptocurrencies. Anonymous cards can be a virtual regular debit card or a plastic card. Most debit card providers we surveyed don't charge any deposit fees, but they all charge withdrawal fees. Most of the time, an online wallet is connected to your crypto debit card via the payment processor to perform private transaction.

Meet RFS Profit Bank

Learn more about RFS Profit and how you can open your bank account in a few easy steps.